New FinFit SafetyNet Platform Helps Every Worker Build and

Maintain Financial Health

Maintain Financial Health

Written by FinFit on January 10th, 2024.

Posted in Press Releases.

The platform that provides financial wellness solutions for every worker announces FinFit’s SafetyNet, a suite of tailored solutions for the financially coping and vulnerable workforce

VIRGINIA BEACH, January 10, 2024 / PRNewswire / — With sixty percent of Americans living paycheck-to-paycheck, today’s workers are in dire need of a financial safety net. Looking to address the challenge facing workers, FinFit today announced FinFit’s SafetyNet, a purpose-built platform that provides solutions for employees facing financial challenges.

“American workers are in a precarious position where any unexpected expense could send them spiralling into financial crisis,” David Kilby, CEO and Founder, FinFit, said. “At FinFit, we believe that a financially healthy person is fairly banked, has prime credit, enough savings to withstand three-to-six months without income, has longer-term savings for retirement, and can afford the life they want with health and happiness. FinFit’s SafetyNet is a suite of products created to help workers reach that level of financial health, simplifying the journey to financial stability, and ensuring everyone can achieve financial peace of mind.”

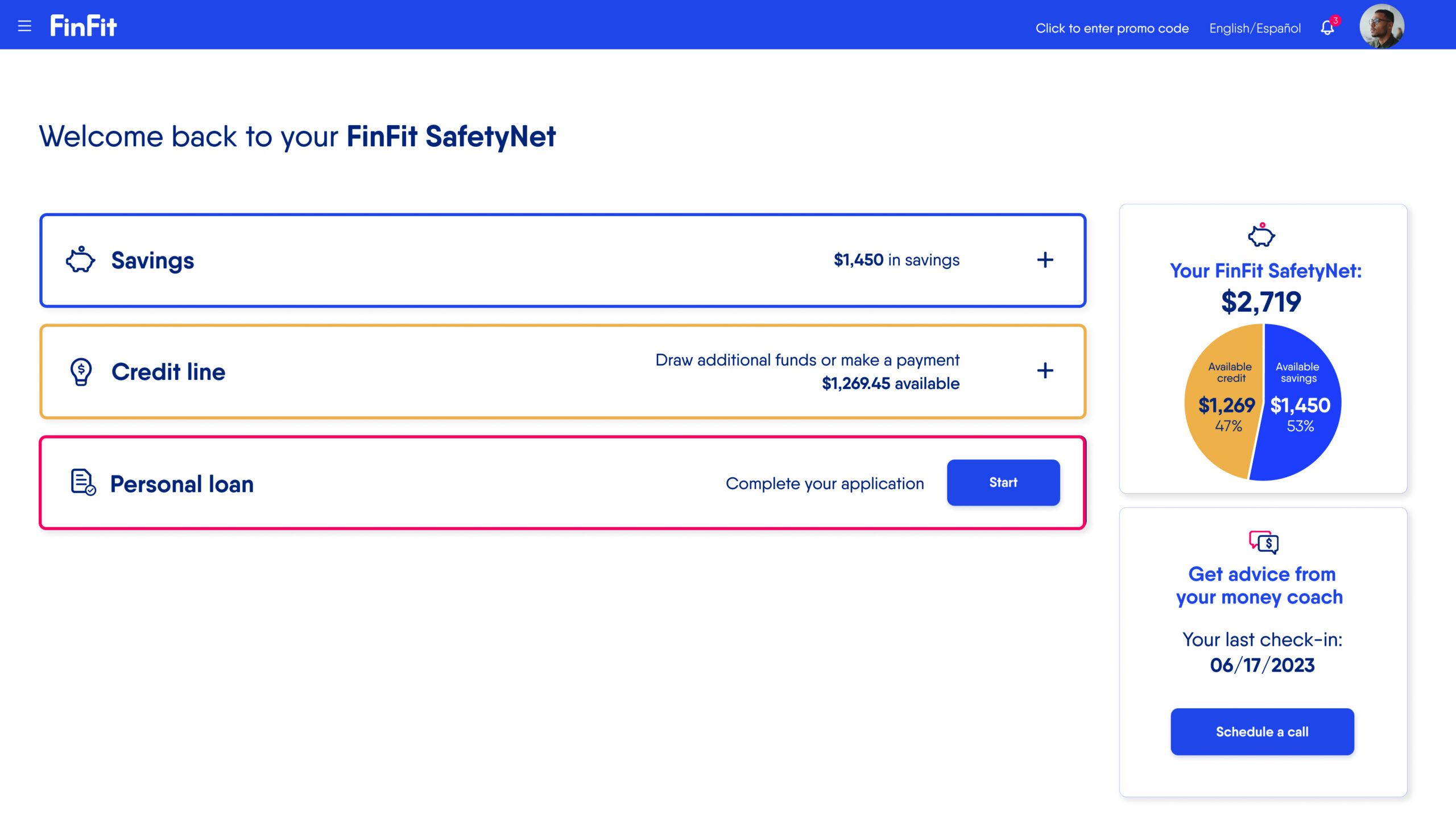

FinFit’s SafetyNet is designed with a proactive, product-forward approach that aligns with the pillars of financial health. For employers, FinFit builds loyalty by providing the resources for workers to regain financial health, directly translating into increased engagement, productivity, health outcomes, and overall return on investment. The core of the FinFit SafetyNet platform is comprised of three modules that are not just solutions but a success ladder for employees to climb as they elevate their financial standing over time:

- Emergency Savings. Designed to help the nearly sixty percent of Americans who aren’t contributing to retirement savings through the workplace to start building short-term liquidity and longer-term savings all in one seamless experience.

- Emergency Credit1. Employees can access funds at any time to cover unexpected expenses or make ends meet between paychecks.

- Debt Consolidation Loans. Employees can pay down debt at lower rates or avoid alternatives like high-cost payday loans or taking money from their 401(k).

The platform also features a toolkit of financial wellness tools and products which benefit from group discounts and increased accessibility, including financial health assessments, unlimited 1:1 financial coaching, and financial dashboards to help with budgeting and goal tracking.

FinFit’s data-driven approach not only forecasts beneficial results but also provides measurable metrics. This capability allows FinFit to showcase concrete outcomes for its employer-clients, translating into substantial savings in areas impacted by financial strain—specifically health repercussions, workforce turnover, absenteeism, and workers’ compensation claims.

“FinFit’s SafetyNet broadens liquidity access to all financially coping employees, encourages savings behaviors to reduce reliance on predatory lending products, and promotes prime credit-building to minimize the cost of mid- to long-term financing needs,” Kilby said. “At the heart of FinFit’s SafetyNet lies a deep understanding of the challenges and aspirations of the financially coping workforce.”

Paychex, Pilgrim’s Pride, and PrismHR are just some of the companies already partnering with FinFit.

To learn more about FinFit’s SafetyNet, please visit: finfit.com/safetynet-demo

About FinFit: FinFit was established in 2008 and currently services over 500,000 organizations across the United States. The company’s SaaS-based model provides holistic financial wellness services that include a personalized financial assessment, premier educational resources, online money management tools, financial coaching, financial solutions, and a member rewards program. Focus on creating positive, healthy financial behaviors and products to support behavioral change has proven to reduce financial stress and increase employee retention by more than 25%.

1Loans subject to credit approval. Rates, terms and conditions are subject to change at any time, without notice. Loans are made by Celtic Bank, a Utah-Chartered Industrial Bank, Member FDIC. Service providers are FinFit Ops, LLC (see licenses) or its affiliate, Salary Finance, Inc. (see licenses). See application terms and loan agreements for more details. Funding time dependent upon funding method selected. Expedited funding may incur additional fees. Residents of Colorado, Connecticut, Iowa, Vermont, Nevada, West Virginia and Massachusetts are not eligible for loans. This does not constitute an offer or solicitation for loan products to residents of those states. Funding time dependent upon funding method selected. Expedited funding may incur additional fees.

Media Contact:

Phil LeClare

Public Relations

FinFit

pleclare@finfit.com

617-209-9406

SOURCE: FinFit