Fix a little work stress with ping pong or fix a lot of employee stress with a Financial Wellness Program

71% of Americans are stressed by money. Take a look around your organization at your employees. Many of the signs of stress are there for you to see:

- Reduced work efficiency or productivity

- Forgetfulness, disorganization, confusion

- Difficulty making decisions

- Reduced punctuality

Financial stress takes a direct toll on businesses, costing them about $250 billion in lost wages1, in part, because employees who are struggling financially may spend two to three hours per week dealing with personal finances rather than doing their work2.

Employee financial struggles can also become an administrative burden for the employer. Four in ten Americans aren’t able to pay for a $400 unexpected expense3. When a financial emergency arises, limited options may include borrowing from family or friends, credit cards, or high-interest payday-loans. The employee may even borrow from their 401k or request a pay advance from their employer. Borrowing from a 401k investment not only hurts the employee in lost interest and potential tax penalties, it can also impact the employer, especially considering that nearly 60% of millennials have taken money from their retirement account4. This practice can negatively impact the employer’s retirement plan asset size, increasing the plan’s administrative expenses.

If an advance is requested on earned pay, this places a burden on the payroll department, with added complications of tax implications, not to mention the additional work involved to administer the advances.This kind gesture by the employer has the potential to snowball out of control.

There is a way for employers to help their employees gain the stability of financial wellness.The solution lies in a holistic financial wellness program offering a variety of tools and educational resources to assist employees in meeting their financial goals. Although the goal is to help employees become educated to make sound financial decisions, a solid financial wellness solution needs to be practical as well. If an employee is struggling to make ends meet, their immediate focus isn’t going to be on learning how to follow a budget. Their financial crisis needs to be solved first. This is where a Financial Wellness program with a short term loan option provides real world help to get the employee back on stable ground, while helping them protect their 401k investment for continued growth.

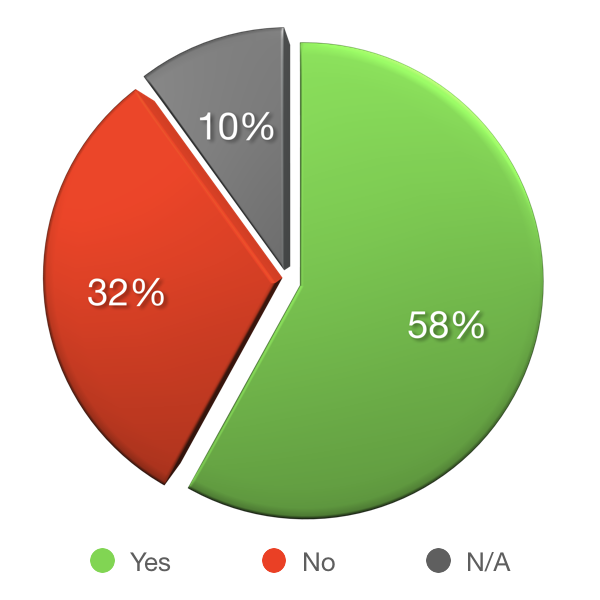

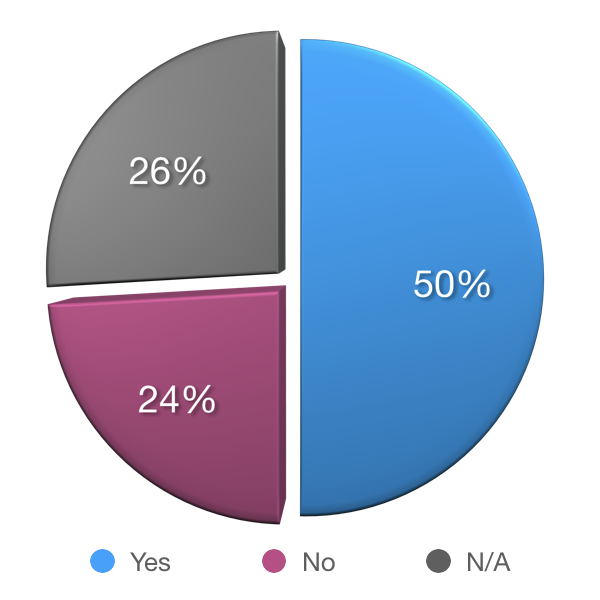

Employers offering FinFit’s Financial Wellness program have reported positive results with 58% experiencing a reduction in 401k loan requests and 50% experiencing a reduction in employee pay advance requests5.

Since offering FinFit, a majority of employers are experiencing a reduction in 401k loan requests.

Since offering FinFit, half of employers have experienced a reduction in pay advance requests.

Employer survey results – 2017 Financial Wellness Survey Commissioned by FinFit, LLC

And while it may be gratifying for employers to offer ping pong tables and free food as perks, you can’t argue with the bottom of line of a successfully implemented Financial Wellness program. Not only do you get to positively impact the overall wellbeing of your employees, in return, you gain the added benefits financially healthy employees bring to the table in reduced absenteeism and healthcare claims, and increased productivity and engagement on the job.

1 Inside Employee Minds (IEM) Financial Wellness survey, 2017 survey by Mercer

2 2018 Employee Financial Wellness Survey

3 Report on the Economic Well-Being of U.S. Households in 2017

4 Majority of young workers have already tapped their retirement savings

5 Employer survey results – 2017 Financial Wellness Survey Commissioned by FinFit, LLC.