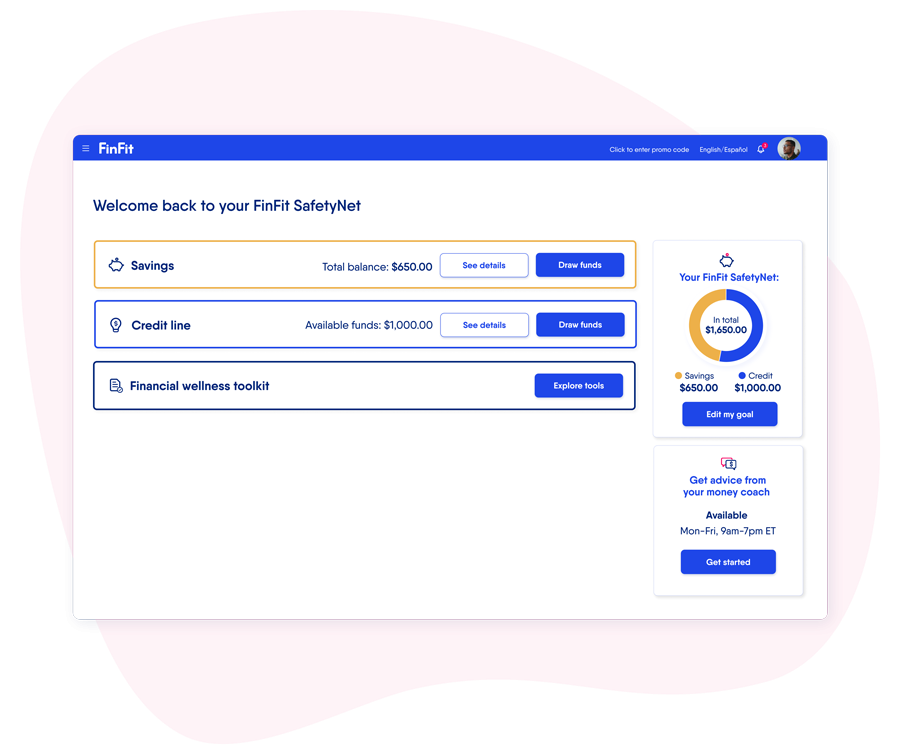

FinFit helps improve and protect employees’ financial health, wherever they are in their journey.

FinFit is the only employee financial wellness solution that combines savings and credit access to create a financial safety net for every worker.

Laddering up employee financial health

In a perfect world, all workers would have access to the banking, credit, personal and retirement savings, and income they need to be able to afford the life they want.

We designed the FinFit SafetyNet platform to deliver that world for every worker, no matter where they are in their financial journey today.

Proven, impactful results for employers and employees

Historically, employee financial wellness solutions haven’t focused on the needs of the two-thirds of the workforce who are living paycheck to paycheck, unable to build up their emergency savings or save for the longer-term. FinFit has worked with tens of thousands of employers from SMB to the enterprise, with measurable results.

-

- 28%improvement in employee retention

- 88%increase in employee productivity

- 40%reduction in 401(k) loans

-

- 89%of financially stressed employees report significant improvements in their wellbeing and stress levels

- 43ptaverage improvement in credit scores

- $10kaverage savings on interest costs per loan

Real employees, real results

Very quick and easy, with great payment terms and much lower interest than anyone else. I absolutely love FinFit for everything financial.

The best thing to come along in a long and critical time. It’s a great vehicle for people in need of short-term help.

Absolutely amazing especially during those hard times. I love the fact that once your loan is approved, you’re able to get the loan within minutes. 🙌🏾